Built For Financial Advisers and Estate Planners

Enable the Great Wealth Transfer

Support intergenerational wealth transfers with robust insights and add greater value to your clients.

Asset Sector Exposure

Holistic Wealth Management

Time is of the essence for Financial Advisers and Estate Planning Lawyers

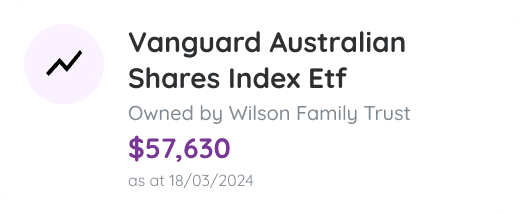

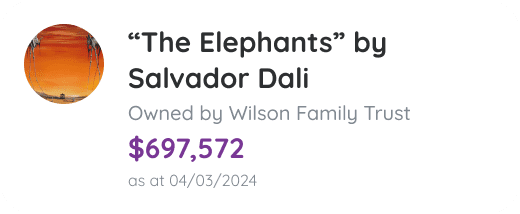

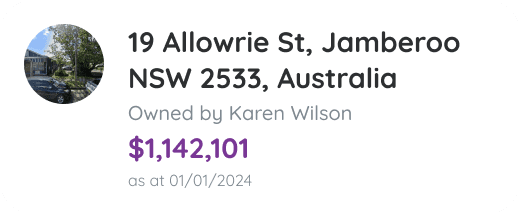

Holistic view of wealth

Improve your client relationships and advice by having access to a truly holistic picture of client wealth. With over 40 asset types visible on HeirWealth, the ability to deliver holistic wealth has never been greater.

Support your business

Strengthen your client relationships and avoid losing funds under management should the head of the family pass away. HeirWealth links wealth to key members and allows for more engaged planning.

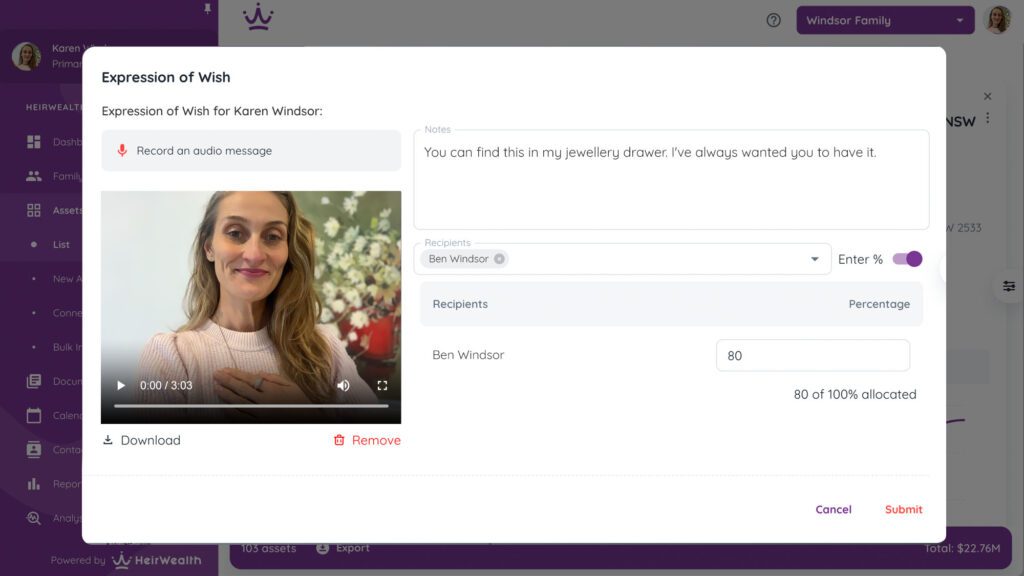

Capture Expressions of Wish

Plan ahead for intergenerational wealth transfers with our Expression of Wish feature. Open up new conversations with the next generation about financial assets and prized collectables.

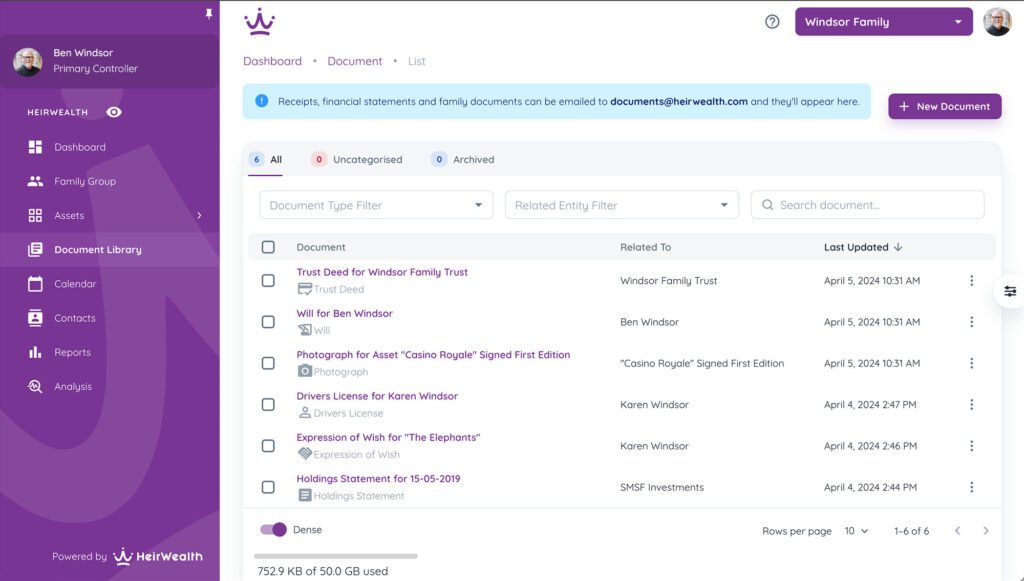

Get organised in the one place

Effortlessly organise, onboard and manage your clients' wealth and add their important financial data & documents into the one secure location.

Key features for Financial Advisers and Estate Planning Lawyers

Holistic view of all wealth

We make financial planning and estate planning easier by giving advisers and their clients the complete picture of wealth across traditional and non-traditional assets.

Enhance your brand offering

HeirWealth can be fully white labelled exclusively to your brand, placing your business in the key position of trusted adviser and educator on your clients' wealth journey.

Secure document vault

By securely storing all of your important client documents within an HeirWealth account, this ensures that all data is centralised and available for when meetings take place or when key events need to be actioned - all without fuss.

Create an Expression of Wish and bring meaning to your clients legacy

Add meaning to family legacies with our Expression of Wish feature. This is unique to HeirWealth and lets users bring sentimental, as well as financial, context to estate wishes. Ultimately adding to engagement and transparency for individual and family clients.

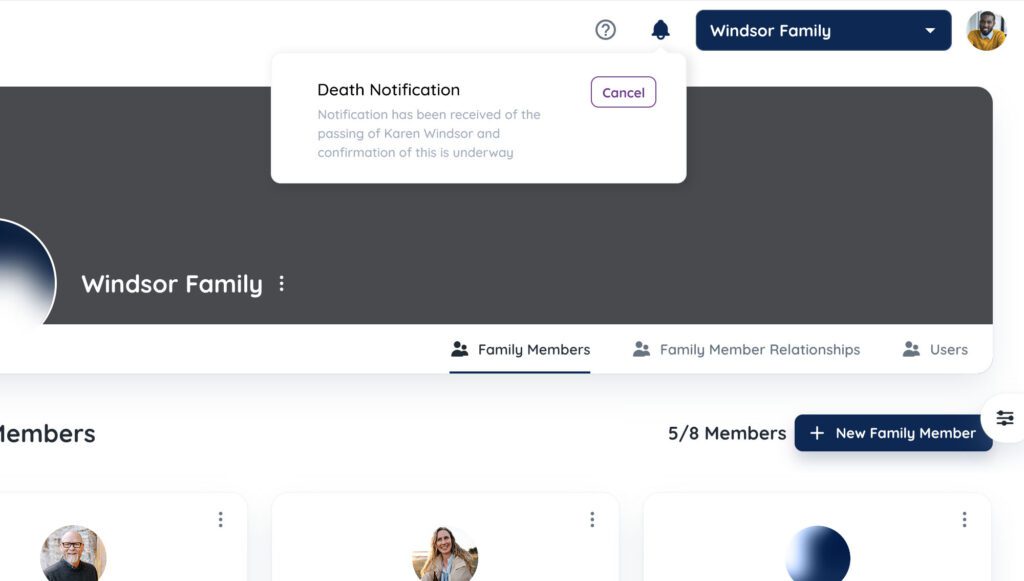

Make critical changes without fuss

Sometimes critical changes are needed when it comes to wealth management and these are can be challenging times. HeirWealth understands this and manages changes with ease and sensitivity, whilst protecting the family account along the way.

Enterprise grade security

Know that your legacy is safe and secure

You control access to all your information. Not even we can access that data!

HeirWealth is certified against ISO27001, known globally as the gold standard for information security management systems.

Don’t just take it from us…

"Sadly I fell into that cohort of people who hadn't thought about the visibility of my finances and just kept a mental filing cabinet of where everything was located. When I saw HeirWealth the benefit was immediately clear. Holding all relevant docs in one place, being able to digitally catalogue them, real time price them and know that should anything happen to me my wife can easily access the family wealth. Complete peace of mind, visibility and clarity."

CEO, Soderberg & Partners Wealth

"I love that HeirWealth allows me to store all of my documents in one place. I can also upload a photo of any asset that I am leaving to someone, and can attach stories, making the distribution of assets in my will a much more personal and engaging experience. I haven’t seen that before anywhere."

Individual User

"The transfer of wealth is an important and proactive task that Heir Wealth facilitates. It creates the discipline of maintaining an accurate register of assets; its calendar events remind my family and other beneficiaries of my estate, to discuss regularly the changing valuations and required updating of the information. It is also a must for succession planning."

Individual

"I feel a great sense of comfort in knowing that HeirWealth prioritises security and is helping to protect my assets and legacy."

Founder & CEO, de.iterate

Questions? We have answers

HeirWealth is a platform for individuals, families and their trusted advisers.

We support a range of professional advisers from accountants, private bankers, lawyers, estate planning specialists, consultants and financial advisers.

To find out more about how this works, contact us at info@heirwealth.com

Yes, you certainly can. HeirWealth allows you to run reports for your clients on their current and past wealth position.

We also allow you to generate a number of reports including balance sheets, insurance contents schedule reports and expression of wish reports.

It’s very easy to sign up with HeirWealth. Simply head to our pricing page and select a package that suits you!

To book a Call with Sales, please visit this calendly link

For more information, contact HeirWealth via info@heirwealth.com

HeirWealth is a platform that helps families and trusted advisers better manage their wealth and intergenerational asset transfers.

The platform, and fully customisable dashboard, creates a living picture of a user’s wealth across 40+ asset classes.

The combination of our suite of integrations and data providers ensures that HeirWealth provides users with automated daily asset valuations in a secure environment.

To book a Call with Sales, please visit this calendly link

For more information, contact HeirWealth via info@heirwealth.com

HeirWealth is built using a zero-knowledge architecture, which means that even our developers and your advisers cannot access your encrypted personal information, unless you allow them access.

Only the people you grant permission will have access to your information.

For more information, contact HeirWealth via info@heirwealth.com

Your personal data is securely stored in a Microsoft Azure cloud database, which is located in the country where you registered your HeirWealth account.

This means if you signed up in Australia, your data will be stored in Australia.

For more information, contact HeirWealth via info@heirwealth.com

No, your personal identifiable data will not be sold or shared. You can however share it with people you grant access to, such as a family member or your adviser on the HeirWealth platform.

HeirWealth encrypts all your data and stores it in a secure location.

However we may share deidentified customer data with trusted third parties that assist us in delivering and improving the HeirWealth app.

These service providers are contractually bound to protect the confidentiality and security of your deidentified personal information.

For further details, please see our privacy policy.

At HeirWealth, we only collect the necessary data to run HeirWealth, and retain all data under a strict security environment.

The data we collect is either provided directly by you or your financial institution, only after you have provided your consent.

For more information, contact HeirWealth via info@heirwealth.com

HeirWealth’s platform provides Open Banking integration which allows users to automatically synchronize financial data and perform daily valuations.

HeirWealth has Open Banking regulatory approvals in Australia and the United Kingdom.

HeirWealth integrates with numerous investment product providers through our integration with Envestnet | Yodlee and a suite of native integrations that includes BGL, Xero and coming soon, Myob and Macquarie.

Alongside these direct integrations, HeirWealth also has data providers for daily pricing of over 150,000 global financial instruments in 170 currencies.

To book a Call with Sales, please visit this calendly link

For more information, contact HeirWealth via info@heirwealth.com

If you need to change the number of users associated with your account, you can do so at anytime.

Primary controllers are able to add or delete users and change their permissions within the user section of the family group page.

For any further information on this, please get in contact with us at info@heirwealth.com

HeirWealth offers a number of pricing plans for individual and professional user types.

To book a Call with Sales, please visit this calendly link

Or please visit our pricing page or contact us for more information at info@heirwealth.com

We’d be sorry to see you go, but if you decide to cancel you can do so at any time.

Whilst only a primary account holder can cancel an account, any user/member associated with a group, can also delete their profile at anytime.

HeirWealth does not offer any refunds (full or partial).

Keep in mind that once a primary account holder cancels an HeirWealth subscription, access will still be available until the end of your billing period. For example, this means if you have paid for a monthly or annual subscription, you will have access until the end of that billing cycle.

For further information on our cancellation terms, please contact HeirWealth separately at info@heirwealth.com

- All features in all plans

- Visibility of over 40+ asset classes